By Collecty Research | Forensic Series: The Giant Client Trap

Reading time: 11 minutes

In March 2021, Greensill Capital filed for insolvency. At its peak, the company had arranged $143 billion in supply chain finance — loans to companies based on their outstanding invoices.

The business model sounded reasonable: buy invoices from suppliers at a discount, give suppliers immediate cash, collect payment from the buyers later, keep the difference.

Except Greensill didn't just finance real invoices. It financed "prospective invoices" — payments for goods and services that hadn't been delivered yet, might not ever be delivered, and in some cases existed only as projections.

When insurers refused to cover Greensill's loans because they couldn't verify the underlying invoices were real, the entire structure collapsed. Credit Suisse froze $10 billion in funds linked to Greensill. Investors discovered their "low-risk trade finance" investments were backed by phantom receivables.

Greensill's collapse wiped out 50,000+ jobs across its client companies, forced UK government bailouts of steel manufacturers, and revealed how "innovative finance" can be a euphemism for fraud.

What Was Greensill?

The Legitimate Version: Supply Chain Finance

Supply chain finance (also called reverse factoring) is a real, useful financial service:

- Supplier delivers goods to a buyer (e.g., Acme Corp supplies widgets to MegaCorp)

- Supplier issues invoice with 60-day payment terms

- Finance company (like Greensill) buys the invoice at a discount (e.g., pays Acme 95% of the invoice value immediately)

- Buyer pays finance company the full invoice amount in 60 days

- Finance company keeps the spread (5% in this example)

Suppliers get immediate cash. Buyers get extended payment terms. Finance companies earn the spread. Everyone wins — if the invoices are real.

The Greensill Version: Prospective Invoicing

Greensill took the model further. It financed "prospective invoices" — invoices for goods and services that might be delivered in the future.

Example:

- GFG Alliance (Greensill's biggest client) projected it would sell $1 billion in steel over the next year

- Greensill advanced GFG $900 million against those projected future sales

- GFG used the cash to operate, expand, and pay debts

- Greensill packaged the prospective invoices as "trade finance" and sold them to investors

The problem: if the future sales didn't happen, or GFG couldn't deliver, the "invoices" were worthless. Greensill was lending against predictions, not actual receivables.

The Sanjeev Gupta Empire

Sanjeev Gupta, through his GFG Alliance conglomerate, became Greensill's largest client. GFG owned:

- Steel mills across the UK, Europe, and Australia

- Energy assets

- Engineering companies

- Commodity trading operations

Greensill financed GFG to the tune of $5+ billion — much of it against prospective invoices.

Critics alleged GFG was using Greensill financing as a revolving loan to cover operational losses and debt, rather than genuine supply chain finance.

The Collapse Timeline

February 2021: Insurance Cancelled

Tokio Marine, the insurer covering Greensill's loans, refused to renew coverage. The reason: Tokio Marine couldn't verify that the underlying invoices were real, deliverable obligations.

Without insurance, Greensill's loans were unprotected. Investors began to panic.

March 1, 2021: Credit Suisse Freezes Funds

Credit Suisse had $10 billion in funds heavily invested in Greensill-linked supply chain finance notes. When the insurance disappeared, Credit Suisse suspended redemptions — investors couldn't withdraw their money.

March 3, 2021: GAM Suspends Fund

Swiss asset manager GAM Investments suspended a fund with $842 million in Greensill exposure.

March 8, 2021: Greensill Files for Insolvency

Greensill Capital filed for administration (UK bankruptcy process). The company owed approximately $10 billion across various creditors and investor funds.

March 15, 2021: GFG Alliance Crisis

GFG Alliance, suddenly without Greensill's financing lifeline, faced a $5 billion debt crisis. The company's steel mills, employing thousands, were at risk of closure.

April-May 2021: Political Scandal

It emerged that former UK Prime Minister David Cameron, who had become an advisor to Greensill after leaving office, had lobbied government ministers on Greensill's behalf. Cameron sent texts to Chancellor Rishi Sunak and other officials seeking access to pandemic loan programs for Greensill.

The lobbying revelations triggered a parliamentary inquiry into conflicts of interest and the revolving door between government and private sector.

The Fraud Mechanics

Prospective Invoicing = Lending on Projections

Greensill's "prospective invoices" were essentially loans secured by the borrower's optimistic forecasts. If the borrower said "we'll sell $1 billion in steel next year," Greensill lent against that projection.

But:

- What if the sales didn't happen?

- What if the buyer refused delivery?

- What if market prices collapsed?

Greensill treated these projections as low-risk trade finance. Insurers and investors eventually realized they were unsecured loans dressed up as invoices.

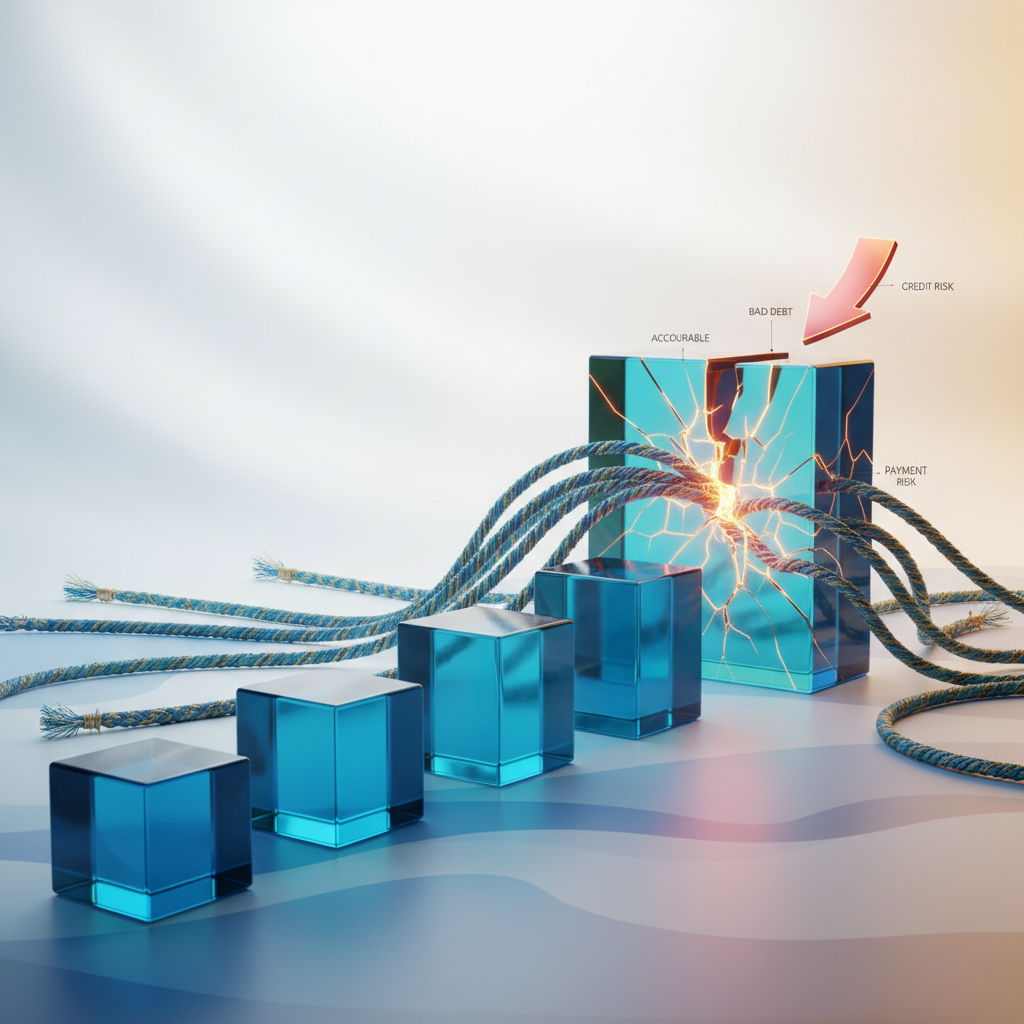

Circular Financing

Investigators found evidence that GFG Alliance used Greensill financing to pay other GFG debts — including previous Greensill loans. The money circulated within the Gupta empire, creating the appearance of revenue without actual underlying trade.

Valuation Manipulation

Greensill valued its loan book at hundreds of millions more than auditors believed was recoverable. When the company collapsed, investors discovered the assets were worth far less than represented.

Lack of Transparency

Greensill's corporate structure was opaque:

- Multiple subsidiaries across jurisdictions

- Complex ownership structures

- Limited disclosure of underlying borrowers and invoice details

Investors bought into "supply chain finance" funds without visibility into whether the invoices were real.

The Casualties

Credit Suisse: $3+ Billion Losses

Credit Suisse's supply chain finance funds, heavily exposed to Greensill, suffered losses exceeding $3 billion. The bank faced lawsuits from investors and regulatory scrutiny over due diligence failures.

GAM Investments: $842 Million Losses

GAM's Greensill-linked fund collapsed. Investors — including pension funds and institutional clients — faced significant losses.

Suppliers and Employees: 50,000+ Jobs at Risk

When GFG Alliance lost Greensill financing, its steel mills faced closure. At peak risk:

- Liberty Steel (UK): 3,000 jobs

- ALVANCE Aluminium (France): 500 jobs

- Steel mills in Australia, UK, Belgium: thousands more

Suppliers to GFG Alliance found invoices unpaid and credit lines frozen.

UK Government: Emergency Bailouts

The UK government arranged emergency financing to keep GFG steel mills operating while restructuring was negotiated. Taxpayer money backstopped a failing conglomerate to prevent mass job losses.

Investors: Billions Frozen

Institutional investors, pension funds, and family offices had billions locked in frozen Greensill-linked funds. Recovery rates remain uncertain.

The Political Scandal: David Cameron

The Revolving Door

In 2018, former UK Prime Minister David Cameron became an advisor to Greensill Capital. Cameron reportedly earned millions in salary and stock options.

Cameron's role raised questions about:

- Access to government officials

- Use of political connections for commercial benefit

- Conflicts of interest

The Lobbying Texts

In April 2021, it was revealed Cameron had sent 56 text messages and calls to government ministers, including:

- Chancellor Rishi Sunak

- Health Secretary Matt Hancock

- Treasury officials

Cameron lobbied for Greensill to access the UK government's COVID Corporate Financing Facility — a pandemic loan program. The requests were denied, but the lobbying revealed how closely Greensill was connected to political power.

Parliamentary Inquiry

A parliamentary committee investigated Cameron's lobbying. Key findings:

- Cameron's actions were legal but "inappropriate"

- The revolving door between government and private sector created conflicts

- New lobbying rules and transparency requirements were recommended

Cameron later apologized, acknowledging he should have communicated via formal channels rather than private texts.

What B2B Suppliers Should Know

Legitimate supply chain finance is backed by real, delivered goods and verified invoices. But Greensill shows the model can be abused. Action: If your client uses supply chain finance, ask:

- Who is the finance provider?

- Are the invoices backed by delivered goods or future projections?

- Is the financing insured?

- What happens to your invoice if the finance provider collapses?

The Aftermath

Criminal Investigations

As of 2024, criminal investigations into Greensill and GFG Alliance are ongoing in multiple jurisdictions, including:

- UK Serious Fraud Office

- German prosecutors

- Australian regulators

Charges have not yet been filed, but investigators are examining potential fraud, false accounting, and misrepresentation.

GFG Alliance Restructuring

GFG Alliance survived Greensill's collapse but remains heavily indebted. The conglomerate has sold assets, restructured debts, and sought new financing. Many of its steel mills continue to operate, though under financial strain.

Credit Suisse Fallout

Credit Suisse's Greensill losses contributed to a broader crisis of confidence in the bank's risk management. In 2023, Credit Suisse was acquired by UBS after facing multiple scandals and losses.

Regulatory Reforms

Regulators in the UK, EU, and Australia have tightened rules around supply chain finance, requiring:

- Greater disclosure of underlying invoices

- Insurance or credit guarantees

- Limits on "prospective" or projection-based financing

- Enhanced due diligence by fund managers

The Lesson

Greensill Capital promised "innovative" supply chain finance. What it delivered was fraud dressed in jargon.

For B2B suppliers, the takeaway is clear: when someone offers you immediate payment for invoices that don't yet exist, you're not getting innovative finance. You're getting a loan with hidden risks.

Real invoices, for delivered goods, with verified buyers — that's supply chain finance.

Projections, forecasts, and "prospective invoices" — that's a house of cards waiting to collapse.

Worried about your client's financing? Collecty specializes in B2B debt recovery and credit risk assessment. 80%+ success rate. 160+ countries. No win, no fee. Free case assessment →

Sources

- Financial Times: "The unravelling of Greensill Capital" (March 2021)

- Wall Street Journal: "How Greensill Went From Billion-Dollar Lender to Bust" (March 2021)

- Bloomberg: "Greensill's $10 Billion Collapse Explained" (March 2021)

- UK Parliament: "Lessons from Greensill Capital" Committee Report (July 2021)

- Credit Suisse: Supply Chain Finance Funds Update (2021-2022)

- The Guardian: "David Cameron lobbying scandal" (April 2021)

- Serious Fraud Office: Greensill Investigation Updates (2021-2024)

- Australian Financial Review: "GFG Alliance debt crisis" (ongoing coverage)

Sarah Lindberg

International Operations Lead

Sarah coordinates our global partner network across 160+ countries, ensuring seamless cross-border debt recovery.