By Collecty Research | Forensic Series: The Giant Client Trap

Reading time: 10 minutes

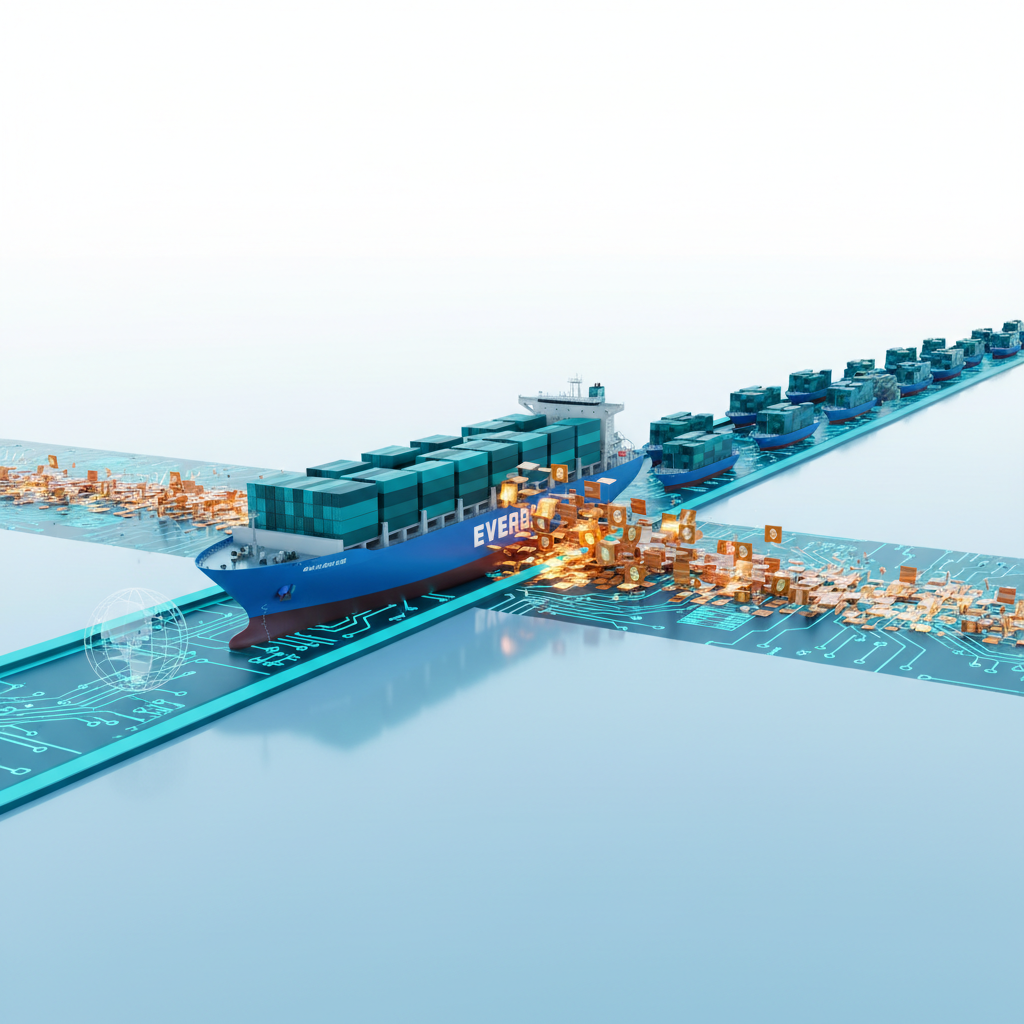

On March 23, 2021, at approximately 7:40 AM local time, the Ever Given — a container ship longer than the Empire State Building is tall — ran aground in the Suez Canal.

The ship wedged itself sideways, bow stuck in one bank, stern in the other, blocking the entire canal.

For six days, one of the world's most critical trade arteries was completely closed. 12% of global seaborne trade — worth approximately $9.6 billion per day — was frozen.

400 ships waited in queue. Supply chains across the world seized. Companies that had perfected "just-in-time" inventory systems discovered what happens when "just in time" becomes "two weeks late."

Maersk, the world's largest container shipping company, reported $89 million in losses from delayed deliveries, missed connections, and contractual penalties.

For B2B suppliers, the Ever Given blockage was a brutal lesson: when your client's shipment is delayed, your invoice payment is delayed. When their supply chain fails, your receivable becomes at risk.

What Happened

The Ship

The Ever Given is a container ship of almost incomprehensible size:

- Length: 400 meters (1,312 feet) — longer than the Empire State Building is tall

- Width: 59 meters (194 feet)

- Capacity: 20,124 TEU (twenty-foot equivalent containers)

- Weight: 220,000 tons fully loaded

- Cargo value: Estimated $1 billion+

The ship was traveling from Malaysia to Rotterdam, carrying everything from furniture to electronics to auto parts.

The Suez Canal

The Suez Canal is a 193-kilometer (120-mile) artificial waterway connecting the Mediterranean Sea to the Red Sea. It allows ships to travel from Europe to Asia without circumnavigating Africa.

Strategic importance:

- 12% of global trade passes through the canal

- 30% of global container traffic

- 5-7% of global oil shipments

- 8% of global liquefied natural gas (LNG)

The alternative route — around the southern tip of Africa — adds:

- 7,000 miles to the journey

- 10-14 days of travel time

- Significant fuel costs

For companies operating on thin margins and tight delivery schedules, the Suez Canal isn't optional — it's essential.

The Incident

March 23, 2021 — 7:40 AM

The Ever Given entered the Suez Canal as part of a northbound convoy. Shortly after entering, a sandstorm struck with winds exceeding 40 knots (74 km/h).

According to reports:

- High winds caused the ship to deviate from its course

- The ship's bow swung toward the eastern bank

- Despite attempts to correct, the ship ran aground

- The stern swung toward the western bank

- The ship became wedged diagonally, completely blocking the canal

Immediate consequences:

- Northbound and southbound traffic completely stopped

- Ships already in the canal were trapped

- New ships began queuing at both ends

The Six-Day Blockage

Day 1-2: Optimism

Initial estimates suggested the ship could be refloated within days. Salvage teams attempted to:

- Dredge sand from around the bow

- Use tugboats to pull the ship

- Wait for high tide to provide lift

None of it worked. The ship was stuck fast.

Day 3-4: Panic

As the blockage extended, the reality set in:

- 400 ships were now waiting (200+ at each end of the canal)

- Cargo value: $9.6 billion per day

- Some ships began rerouting around Africa

- Oil prices rose 6% on supply concerns

- Shipping rates spiked

Day 5-6: Breakthrough

March 28-29, 2021

A combination of factors finally worked:

- Dredgers removed 30,000 cubic meters of sand

- High tide provided extra lift

- 14 tugboats pulled simultaneously

- The ship's bow lifted slightly

- The stern swung free

March 29, 3:00 PM: The Ever Given was fully refloated.

The canal reopened. The backlog of 400 ships began moving. But the damage was done.

The Casualties

Shipping Companies: $89M+ in Losses

Maersk reported $89 million in direct losses from:

- Delayed deliveries (contractual penalties)

- Rerouted ships (extra fuel and time)

- Missed connections (containers stranded at wrong ports)

- Customer compensation

Other major carriers (MSC, CMA CGM, Hapag-Lloyd) reported similar losses.

Manufacturers: Supply Chain Chaos

IKEA:

Furniture shipments delayed by 2-3 weeks. Stores ran out of popular items during peak spring sales season.

Peloton:

Exercise bikes stuck at sea during the pandemic fitness boom. Delays cost millions in lost sales and customer goodwill.

Automotive:

Just-in-time parts deliveries failed. Assembly lines in Europe slowed or stopped. Some plants went on reduced schedules.

Oil & Gas:

$54 billion in crude oil was stuck on tankers. Refineries adjusted production schedules. Spot prices spiked.

Retailers: Empty Shelves

Retailers expecting inventory for spring sales found:

- Shipments delayed 2-4 weeks

- Competitor stock sold out while theirs was at sea

- Customer orders cancelled

- Revenue lost permanently (seasonal goods missed their season)

Suppliers: Payment Delays

B2B suppliers whose goods were on delayed ships faced:

- Payment terms starting from delivery, not shipment

- Clients unable to pay until they received and sold goods

- Cash flow gaps lasting weeks

- Some clients cancelling orders entirely if goods arrived too late

The Compensation Battle

Egypt's Claim: $1 Billion

The Suez Canal Authority (SCA) claimed $1 billion in damages:

- Lost canal fees (estimated $15M/day)

- Salvage operation costs ($15M+)

- Reputation damage

- Equipment wear and tear

The SCA detained the Ever Given for three months, refusing to let it leave Egyptian waters until compensation was paid.

The Ship Owner's Defense

The Ever Given is owned by Shoei Kisen Kaisha (Japan) and operated by Evergreen Marine (Taiwan). They argued:

- The incident was caused by weather ("Act of God")

- The canal's pilots (employed by SCA) were responsible for navigation

- $1 billion was excessive

The Settlement

After months of negotiation, a settlement was reached for an undisclosed amount (estimated $200-500 million). The Ever Given was released in July 2021.

Insurance covered most of the payout, but insurers raised premiums for subsequent Suez Canal transits.

What B2B Suppliers Learned

Lesson 1: Payment Timing Depends on Delivery Timing

Most B2B payment terms are:

- Net 30 from delivery

- Net 45 from receipt of goods

- Net 60 from invoice date (triggered by delivery)

If shipment is delayed:

- Delivery is delayed

- Payment terms don't start

- Your cash flow is frozen

Ever Given example:

You shipped goods on March 15, expecting delivery April 1, payment May 1. Shipment gets stuck in the Suez Canal until April 15. New payment date: June 15. 45-day delay in payment.

Lesson 2: Supply Chain Risk = Payment Risk

If your client's supply chain is fragile:

- One blockage can freeze their operations

- Frozen operations mean frozen cash flow

- Frozen cash flow means delayed vendor payments

Red flags:

- Client relies on single-source suppliers

- Just-in-time inventory with no buffer stock

- Long-distance sea freight with no backup plan

- Critical components coming through Suez or Panama Canal

Lesson 3: "Just in Time" Is Fragile

Just-in-Time (JIT) inventory was perfected by Toyota and adopted globally:

- Minimize inventory holding costs

- Order parts to arrive exactly when needed

- No buffer stock, no waste

The Ever Given exposed JIT's weakness:

- One disruption stops everything

- No backup inventory to cover delays

- Entire production lines shut down

For suppliers:

If your client operates JIT, they're optimizing for efficiency at the expense of resilience. One disruption = your payment at risk.

Lesson 4: Geographic Diversification Matters

Companies that sourced from multiple regions (e.g., Asia + Europe + Americas) weathered the crisis better than companies sourcing exclusively from Asia via Suez.

Action: If your client sources 80%+ of inputs from a single geographic region accessed via one choke point (Suez, Panama Canal, Strait of Malacca), they're vulnerable.

Lesson 5: Force Majeure Clauses Matter

Many contracts have force majeure clauses — provisions that excuse non-performance due to unforeseeable events.

The Ever Given triggered force majeure claims:

- Buyers invoked force majeure to delay or cancel orders

- Sellers invoked force majeure to excuse late delivery

- Suppliers invoked force majeure to excuse delayed raw materials

If your contract lacks a clear force majeure clause (or if it's one-sided), you're at risk when disruptions happen.

The Aftermath

Insurance Premiums Rose

Marine insurance rates for Suez Canal transits increased 10-20%. The Ever Given proved that even "safe" routes have catastrophic risk.

Canal Widening Accelerated

Egypt announced plans to widen portions of the Suez Canal to reduce future blockage risk. But the canal remains vulnerable to large ship groundings.

Just-in-Time Rethought

Many companies added buffer stock and redundant suppliers post-Ever Given. The pendulum swung back toward resilience over pure efficiency.

Mega-Ship Concerns

Container ships have grown steadily larger (the Ever Given was already massive; newer ships are bigger). Critics argue canals, ports, and infrastructure aren't designed for these mega-ships.

The Ever Given proved that bigger isn't always better when one ship can block global trade.

What B2B Suppliers Should Do

Ask your major clients:

- Do you source from multiple regions?

- Do you maintain buffer inventory?

- What's your backup plan if Suez/Panama is blocked?

- Do you have air freight contingency for critical items?

The Bigger Picture

The Ever Given blockage lasted six days and cost tens of billions in economic disruption. But it taught a lesson worth far more:

Global supply chains are optimized for efficiency, not resilience.

One ship, sideways, proved that "just in time" can become "never arrived" with shocking speed.

For B2B suppliers, the lesson is clear: your client's supply chain fragility is your payment risk.

When their shipments are delayed, your invoices are delayed. When their supply chain fails, your receivables are at risk.

The Ever Given is gone. But the vulnerabilities it exposed remain.

Supply chain disruptions affecting your receivables? Collecty specializes in B2B debt recovery across 160+ countries. 80%+ success rate. No win, no fee. Free case assessment →

Sources

- Lloyd's List: Ever Given grounding coverage (March-July 2021)

- Suez Canal Authority: Official incident reports and traffic data

- Maersk: Q1 2021 earnings call and Ever Given impact statement

- Financial Times: "The Ever Given and the fragility of global supply chains" (April 2021)

- Bloomberg: Ever Given compensation battle coverage (2021)

- Marine Traffic: Vessel tracking and canal traffic analysis

- S&P Global: Commodity price impact analysis

- Wall Street Journal: Supply chain disruption series (2021)

Sarah Lindberg

International Operations Lead

Sarah coordinates our global partner network across 160+ countries, ensuring seamless cross-border debt recovery.