By Collecty Research | Forensic Series: The Giant Client Trap

Reading time: 12 minutes

On June 25, 2020, Wirecard AG — a payment processor valued at €32 billion and a member of Germany's prestigious DAX 30 stock index — admitted that €1.9 billion in cash reported on its balance sheet "probably doesn't exist."

The money had never existed.

Four days later, Wirecard filed for insolvency. The CEO was arrested. The COO fled to Russia. Investors lost €32 billion. Creditors were owed €3.5 billion. 5,600 employees lost their jobs.

Wirecard wasn't a startup that overpromised and failed. It was a fraud — one of the largest corporate frauds in European history. For years, executives fabricated revenue, forged bank statements, and created phantom third-party partners to hide the fact that the company's core business didn't work.

What makes Wirecard extraordinary isn't just the scale of the fraud. It's how long it lasted despite:

- Auditors from Ernst & Young (EY) signing off on accounts for years

- Journalists from the Financial Times publishing detailed exposés

- Regulators investigating... the journalists, not Wirecard

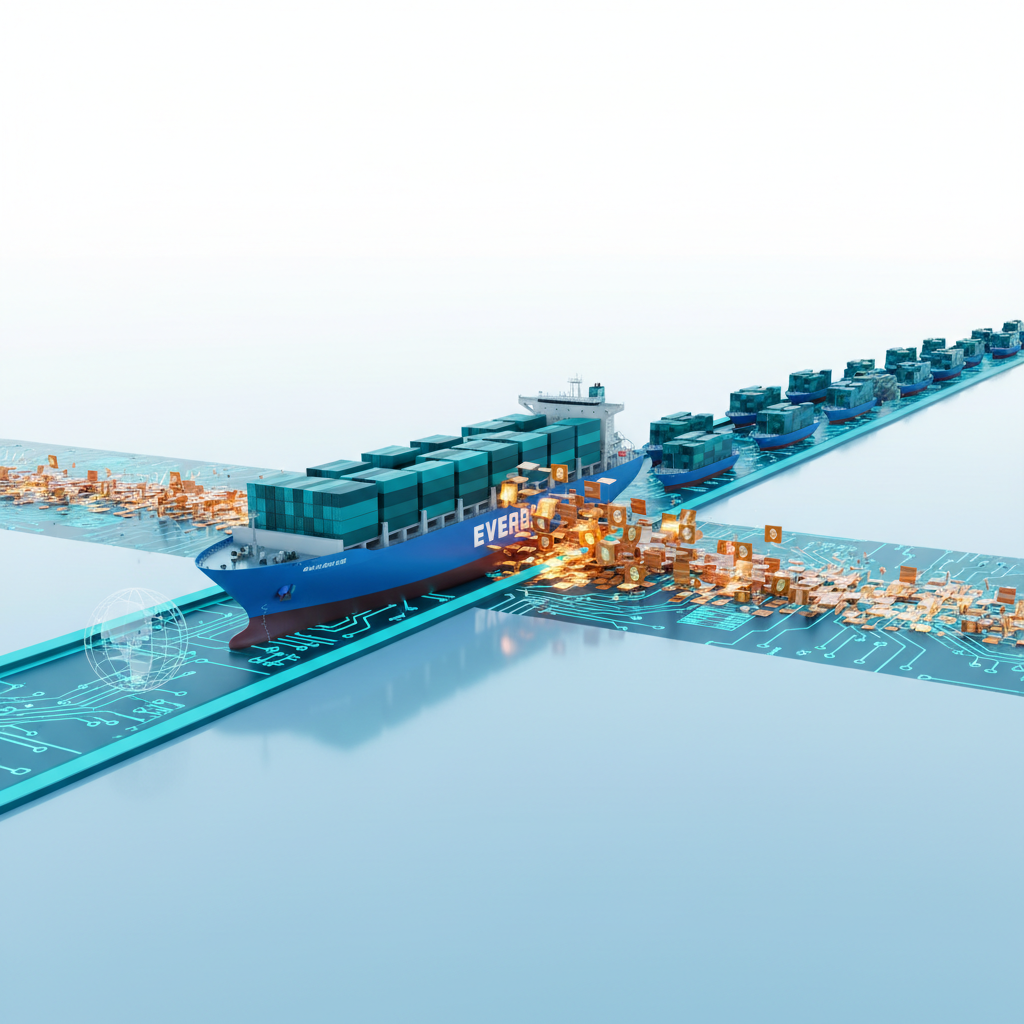

This is the story of how a fraud hides in plain sight — and what B2B suppliers should learn about clients whose corporate structures are too complex to understand.

What Was Wirecard?

The Legitimate Business

Wirecard claimed to be a payment processor — the infrastructure that allows businesses to accept credit cards and digital payments. Think of it as the plumbing behind e-commerce checkouts.

The company positioned itself as a tech disruptor in an industry dominated by older players like Worldpay and Adyen. Wirecard's pitch:

- Digital-first

- Global reach

- Expertise in high-risk merchants (gambling, adult content, etc.)

By 2018, Wirecard was valued at €24 billion — larger than Deutsche Bank. In 2018, it joined the DAX 30, Germany's blue-chip stock index, replacing Commerzbank.

The Fake Business

Wirecard reported that roughly 50% of its revenue came from "third-party acquirers" (TPAs) in Asia — partners who processed payments on Wirecard's behalf in regions where Wirecard didn't have direct infrastructure.

These TPAs allegedly processed billions in transactions and held €1.9 billion in cash "in trust" for Wirecard in accounts in the Philippines and Singapore.

The problem: the TPAs were fake, the transactions were fake, and the cash was fake.

The Fraud Mechanics

Phantom Partners

Wirecard claimed to work with third-party payment processors in Asia — companies with names like:

- Al Alam Solutions

- PayEasy

- Senjo Group

These companies supposedly processed payments for major e-commerce clients in Asia and the Middle East. Wirecard reported hundreds of millions in revenue and profit from these partnerships.

Investigations later revealed:

- Some of these companies didn't exist

- Others existed but had no significant business with Wirecard

- Transaction volumes were fabricated

- Financial statements were forged

Fake Revenue

Wirecard booked revenue from these phantom partners as if it were real:

- Falsified sales contracts

- Created fake invoices

- Fabricated payment confirmations

The revenue appeared in Wirecard's financial statements. Auditors reviewed the documents. Everything looked legitimate — because the documents were professionally forged.

Fabricated Cash Balances

Wirecard claimed that cash from TPA transactions was held in bank accounts in the Philippines and Singapore — totaling €1.9 billion.

To satisfy auditors, Wirecard provided:

- Bank statements

- Account confirmations

- Trustee letters

All forgeries.

The banks confirmed they had no record of the accounts. The money didn't exist.

Round-Tripping

Some revenue was "round-tripped" — Wirecard sent money to fake partners, who sent it back, and Wirecard recorded it as revenue. The cash moved in circles, creating the illusion of business activity.

The Financial Times Investigation

Between 2015 and 2020, Financial Times journalist Dan McCrum published a series of investigations into Wirecard, alleging:

- Fabricated revenue

- Fake partners

- Fraudulent accounting

- Money laundering

McCrum and his team:

- Interviewed former employees

- Traced corporate structures

- Verified (or couldn't verify) claimed partnerships

- Analyzed forensic accounting red flags

Wirecard's response:

- Sued the Financial Times for defamation

- Hired law firms to threaten journalists

- Commissioned "independent" reports defending the company

- Claimed the reporting was a coordinated short-seller attack

BaFin's Bizarre Response

Germany's financial regulator, BaFin, didn't investigate Wirecard. Instead, it:

- Investigated the Financial Times and the journalists

- Banned short-selling of Wirecard stock (to "protect" the company)

- Referred journalists to prosecutors for potential market manipulation

BaFin treated Wirecard as a victim of malicious reporting, not a potential fraud. The decision later became a national embarrassment.

The Collapse

June 2020: The Auditor's Crisis

Ernst & Young (EY), Wirecard's auditor, had signed off on the company's accounts for years. But in June 2020, EY demanded independent verification of the €1.9 billion cash balance held by TPAs in Asia.

Wirecard provided documents. EY asked for direct bank confirmations.

June 18, 2020:

Two banks in the Philippines confirmed they had no accounts under the names Wirecard provided.

June 22, 2020:

EY announced it could not verify the cash and refused to sign Wirecard's 2019 audit.

Without a signed audit, Wirecard was in breach of its loan covenants. Creditors could demand immediate repayment of €2 billion in debt.

June 25, 2020: The Admission

Wirecard issued a statement:

"The Management Board of Wirecard assesses on the basis of further examination that there is a prevailing likelihood that the bank trust account balances in the amount of €1.9 billion do not exist."

Translation: the money was never real.

The stock fell 85% in a single day.

June 25, 2020 (later that day):

CEO Markus Braun resigned and was arrested.

June 29, 2020:

Wirecard filed for insolvency.

July 2020:

COO Jan Marsalek — the executive who allegedly orchestrated much of the fraud — disappeared. He is believed to have fled to Russia and remains at large.

The Criminal Aftermath

Markus Braun (CEO)

- Arrested June 2020

- Charged with fraud, embezzlement, market manipulation

- Convicted December 2022

- Sentenced to 11 years in prison

Braun maintained he was unaware of the fraud and was himself deceived by Marsalek and others.

Jan Marsalek (COO)

- Chief operating officer, allegedly the architect of the fraud

- Fled Germany in June 2020

- Last confirmed sighting: Russia

- Interpol Red Notice issued

- Still at large as of 2024

Oliver Bellenhaus (CFO)

- Arrested and charged

- Cooperating with prosecutors

- Provided evidence against Braun and others

Stephanie Denner & Others

- Multiple executives and employees charged with complicity

- Ongoing trials in Germany

The Audit Failure: Ernst & Young's Role

EY relied on bank confirmations provided by Wirecard, rather than contacting banks directly. The confirmations were forged.

The Regulatory Failure: BaFin

Germany's financial regulator, BaFin:

- Investigated journalists instead of Wirecard

- Banned short-selling to "protect" Wirecard's stock price

- Failed to conduct meaningful oversight despite multiple red flags

Post-collapse, BaFin's leadership was overhauled, and new regulations were introduced requiring more aggressive fraud detection.

The B2B Supplier Lessons

Wirecard's corporate structure was intentionally complex: Complexity serves two purposes: Legitimate operational reasons Hiding fraud Action: If you can't easily understand how your client makes money, or if their structure seems needlessly complex, dig deeper.

- Dozens of subsidiaries

- Opaque third-party relationships

- Revenue booked in hard-to-verify jurisdictions

- Legitimate operational reasons

- Hiding fraud

The Aftermath

Wirecard's Assets

Wirecard's legitimate payment processing businesses were sold:

- North American business acquired by Syncapay

- European operations broken up and sold

Recovery for creditors and investors is minimal — most assets were intangible (customer relationships, technology) and collapsed with the brand.

Legislative Reforms

Germany introduced:

- Stricter auditor independence rules

- Enhanced fraud detection requirements

- Greater BaFin oversight powers

- Protections for whistleblowers

Investor Lawsuits

Thousands of investors, including pension funds and institutional clients, have sued:

- Wirecard executives

- Ernst & Young

- BaFin

Litigation continues.

The Bigger Picture

Wirecard is a case study in:

- Audit failure: How professional skepticism disappeared

- Regulatory capture: How regulators protected the wrong party

- Journalistic courage: The Financial Times persisted despite lawsuits

- Corporate fraud at scale: €1.9 billion in fake cash, hidden for years

For B2B suppliers, the lesson is stark: if a €32 billion company audited by EY and regulated by BaFin can be a complete fraud, your client might be too.

Don't trust complexity. Don't trust prestigious auditors. Don't trust regulatory approval.

Verify. Always verify.

Worried about a client's financials? Collecty specializes in B2B debt recovery and credit risk assessment. 80%+ success rate. 160+ countries. No win, no fee. Free case assessment →

Sources

- Financial Times: Dan McCrum's Wirecard investigation series (2015-2020)

- Munich District Court: Markus Braun trial verdict (December 2022)

- Bundestag: Wirecard parliamentary inquiry reports (2020-2021)

- BaFin: Post-Wirecard regulatory reforms (2021)

- Ernst & Young: Wirecard audit failure analysis (various)

- BBC: "Wirecard: The Billion Euro Lie" documentary (2021)

- The Guardian: Wirecard collapse coverage (2020-2024)

- Interpol: Jan Marsalek Red Notice (ongoing)

Sarah Lindberg

International Operations Lead

Sarah coordinates our global partner network across 160+ countries, ensuring seamless cross-border debt recovery.